Renters make up about one-fifth of households in the UK, with the majority of these homes owned by private landlords. With 2020 proving difficult for homeowners and tenants alike, as well as vastly disrupting the property industry, this report analyses the current state of renting and the buy-to-let market, as well as how Covid-19 has impacted them.

Key Findings

- British renters spend, on average 30.93% of their income on rent, an increase of 1% between 2019 and 2020.

- Glasgow provides the best rental yield of any UK city, with an estimated return of 7.52%.

- The rent in 4 London boroughs is more than 80% of the borough’s average salary.

Jump to

Regional Analysis

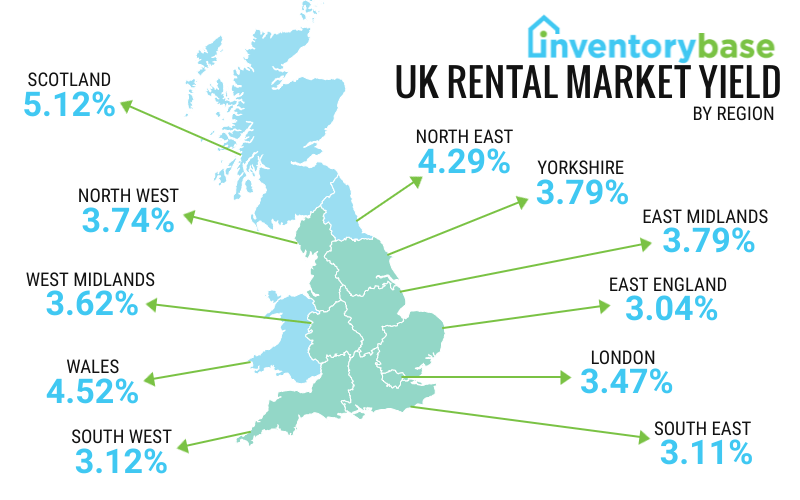

Rental Yield Map – by Region

Rental Yield by Region

| Region | Average Monthly Rent | Average Annual Rent | Average House Price | Estimated Yield |

| Scotland | £689 | £8,268 | £161,529 | 5.12% |

| Wales | £677 | £8,124 | £179,861 | 4.52% |

| North East | £495 | £5,940 | £138,370 | 4.29% |

| Yorkshire | £575 | £6,900 | £182,220 | 3.79% |

| North West | £575 | £6,900 | £184,351 | 3.74% |

| West Midlands | £650 | £7,800 | £215,451 | 3.62% |

| London | £1,435 | £17,220 | £496,269 | 3.47% |

| East Midlands | £600 | £7,200 | £213,967 | 3.37% |

| South West | £725 | £8,700 | £279,242 | 3.12% |

| South East | £895 | £10,740 | £345,075 | 3.11% |

| East of England | £775 | £9,300 | £306,346 | 3.04% |

Despite properties being cheaper in the North East of England, buyers in Wales and Scotland could see better returns on their BTL investment.

The pent-up demand for houses during the initial UK lockdown, as well as the stamp duty holiday and other contributing factors has led house prices across the UK to reach record highs. This has not caused a distinct rise in rents, however, which could suggest a lower yield in 2021 than in previous years.

Rent as a Percentage of Income by Region

| Region | Average Monthly Rent | Median Weekly Pay | Estimated Monthly Pay | % of Monthly Income |

| London | £1,435 | £716 | £3083 | 46.54% |

| South East | £895 | £632 | £2,528 | 35.40% |

| East of England | £775 | £605 | £2,420 | 32.02% |

| South West | £725 | £558 | £2,232 | 32.48% |

| West Midlands | £650 | £552 | £2,208 | 29.44% |

| East Midlands | £600 | £561 | £2,244 | 26.74% |

| North West | £575 | £560 | £2,240 | 25.67% |

| Yorkshire | £575 | £540 | £2,160 | 26.62% |

| North East | £495 | £524 | £2,096 | 23.61% |

| Scotland | £689 | £593 | £2,372 | 29.05% |

| Wales | £677 | £538 | £2,152 | 31.46% |

| All UK | £725 | £586 | £2,344 | 30.93% |

London is the only area where rent costs more than 50% of the average salary in the region. The North East is the easiest on tenants, where rent only amounts to just under 24% of average income.

Change in Rent as a Percentage of Income 2019-2020

Overall, the percentage of income spent on rent increased across the UK by around 1%. Most regions saw an increase in rent costs when compared with estimated average salaries. However, the few that saw a drop include London, the East of England, the East Midlands and Scotland.

The fall in London rents has been attributed to the limitations on travel that pushed short-term lets onto the market, inflating supply past demand. London has also seen an exodus of many new remote workers who have chosen homes further afield, meaning the disruption to supply and demand in the capital could continue beyond Covid restrictions.

Landlords and Tenants

Landlord Property Location

In every region, landlords tend to purchase properties in the region they themselves live. The lowest percentage of landlords buying in their own area is in the South East, where 14% own property in London and 7% in the East of England.

Tenant Length of Stay

One-fifth of tenants in the private rented sector move home every 1-2 years. However, just as many tenants stay in their homes for 5-10 years as 2-3, and the majority of tenants

City Analysis

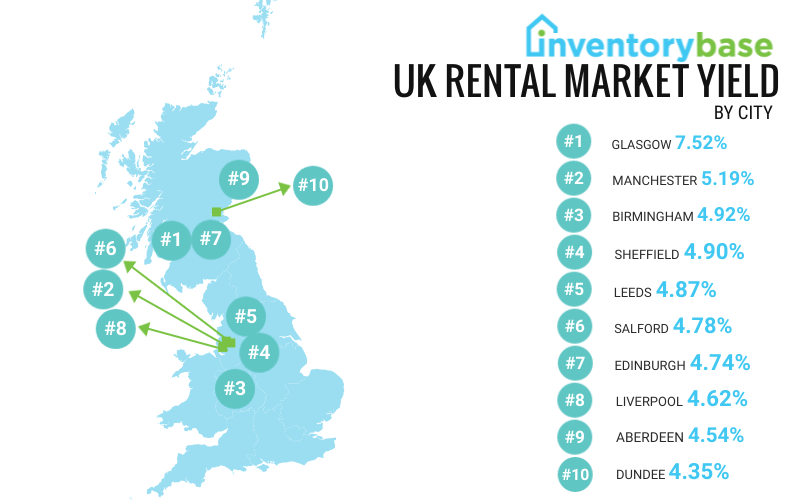

Highest Rental Yield by City – Map

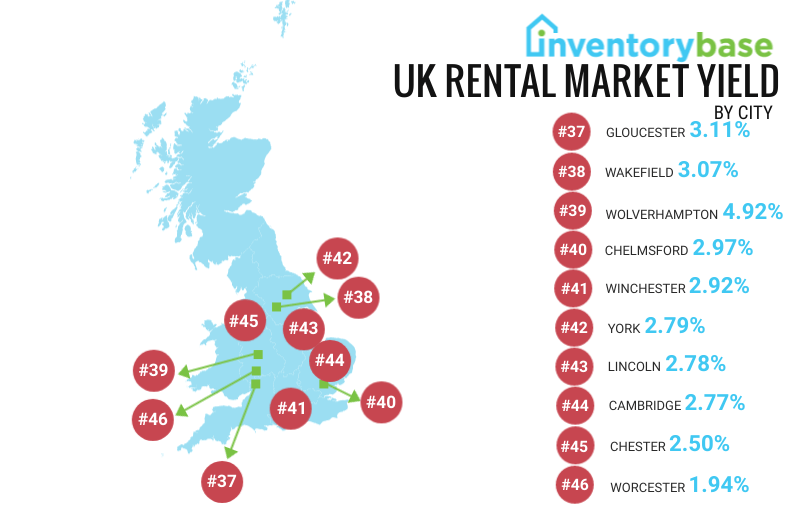

Lowest Rental Yield by City – Map

Rental Yield by City

Four of the top 10 cities for rental yield are in Scotland, highlighting it as the hotspot for BTL investors in 2021. Despite being the city with the highest rents, London ranks low thanks to its prohibitively high property costs.

Glasgow’s relatively high rent costs compared with the average cost of property put it firmly ahead of any other UK city in terms of return on investment.

| City | Average Rent P/A | House Prices | Estimated Rental Yield |

| Glasgow | £9,516 | £126,600 | 7.52% |

| Manchester | £9,600 | £185,000 | 5.19% |

| Birmingham | £8,700 | £176,800 | 4.92% |

| Sheffield | £7,200 | £147,000 | 4.90% |

| Leeds | £8,700 | £178,600 | 4.87% |

| Salford | £8,700 | £182,000 | 4.78% |

| Edinburgh | £11,400 | £240,600 | 4.74% |

| Liverpool | £6,000 | £129,800 | 4.62% |

| Aberdeen | £6,540 | £144,200 | 4.54% |

| Dundee | £7,800 | £179,300 | 4.35% |

| Stirling | £9,900 | £231,000 | 4.29% |

| Nottingham | £7,140 | £168,700 | 4.23% |

| Bradford | £6,000 | £142,100 | 4.22% |

| Cardiff | £9,072 | £217,300 | 4.17% |

| Newport | £8,112 | £197,300 | 4.11% |

| Norwich | £10,812 | £263,400 | 4.10% |

| Bristol | £11,940 | £291,500 | 4.10% |

| Southampton | £9,360 | £231,300 | 4.05% |

| Sunderland | £5,940 | £147,900 | 4.02% |

| Swansea | £7,176 | £185,800 | 3.86% |

| Coventry | £8,340 | £216,300 | 3.86% |

| Preston | £7,440 | £193,900 | 3.84% |

| Newcastle | £7,800 | £206,600 | 3.78% |

| Portsmouth | £9,300 | £246,900 | 3.77% |

| Peterborough | £7,920 | £211,600 | 3.74% |

| Leicester | £7,200 | £194,800 | 3.70% |

| Carlisle | £5,724 | £161,900 | 3.54% |

| London | £17,220 | £496,269 | 3.47% |

| Bath | £14,460 | £417,900 | 3.46% |

| Kingston upon Hull | £4,944 | £143,700 | 3.44% |

| Stoke on Trent | £5,400 | £157,100 | 3.44% |

| Brighton | £13,140 | £388,700 | 3.38% |

| Derby | £7,080 | £217,400 | 3.26% |

| Exeter | £9,840 | £306,600 | 3.21% |

| Oxford | £15,600 | £491,800 | 3.17% |

| Plymouth | £6,804 | £215,600 | 3.16% |

| Gloucester | £7,800 | £250,600 | 3.11% |

| Wakefield | £6,600 | £214,700 | 3.07% |

| Wolverhampton | £6,780 | £223,100 | 3.04% |

| Chelmsford | £11,388 | £383,000 | 2.97% |

| Winchester | £15,600 | £534,800 | 2.92% |

| York | £9,000 | £322,900 | 2.79% |

| Lincoln | £5,976 | £214,700 | 2.78% |

| Cambridge | £12,012 | £433,900 | 2.77% |

| Chester | £6,912 | £276,600 | 2.50% |

| Worcester | £5,724 | £295,000 | 1.94% |

Rent as a Percentage of Income by City

Winchester, Bath and Oxford all beat out London for comparative rent costs and average annual salary. Salford is the only city in the north to place in the top 10, with renters there paying an average of just below 40% of their wage on rent.

Conversely, the 5 cities with the lowest percentage of income spent on rent are all in the North or Scotland, with Aberdeen residents paying less than 20% of their average salary on rent.

| City | Average Rent P/A | Average Annual Pay | Rent as % of Income |

| Winchester | £15,600 | £29,000 | 53.79% |

| Bath | £14,460 | £28,000 | 51.64% |

| Oxford | £15,600 | £31,000 | 50.32% |

| Brighton | £13,140 | £28,000 | 46.93% |

| London | £17,220 | £37,000 | 46.54% |

| Norwich | £10,812 | £26,000 | 41.58% |

| Chelmsford | £11,388 | £28,000 | 40.67% |

| Salford | £8,700 | £22,000 | 39.55% |

| Cambridge | £12,012 | £31,000 | 38.75% |

| Bristol | £11,940 | £31,000 | 38.52% |

| Stirling | £9,900 | £26,000 | 38.08% |

| Edinburgh | £11,400 | £31,000 | 36.77% |

| Exeter | £9,840 | £27,000 | 36.44% |

| York | £9,000 | £27,000 | 33.33% |

| Manchester | £9,600 | £29,000 | 33.10% |

| Glasgow | £9,516 | £29,000 | 32.81% |

| Cardiff | £9,072 | £28,000 | 32.40% |

| Southampton | £9,360 | £29,000 | 32.28% |

| Portsmouth | £9,300 | £29,000 | 32.07% |

| Newport | £8,112 | £27,000 | 30.04% |

| Birmingham | £8,700 | £29,000 | 30.00% |

| Leeds | £8,700 | £29,000 | 30.00% |

| Dundee | £7,800 | £26,000 | 30.00% |

| Peterborough | £7,920 | £27,000 | 29.33% |

| Newcastle | £7,800 | £27,000 | 28.89% |

| Swansea | £7,176 | £25,000 | 28.70% |

| Preston | £7,440 | £26,000 | 28.62% |

| Gloucester | £7,800 | £28,000 | 27.86% |

| Coventry | £8,340 | £30,000 | 27.80% |

| Sheffield | £7,200 | £26,000 | 27.69% |

| Leicester | £7,200 | £26,000 | 27.69% |

| Wolverhampton | £6,780 | £25,000 | 27.12% |

| Nottingham | £7,140 | £27,000 | 26.44% |

| Wakefield | £6,600 | £25,000 | 26.40% |

| Derby | £7,080 | £27,000 | 26.22% |

| Plymouth | £6,804 | £26,000 | 26.17% |

| Chester | £6,912 | £27,000 | 25.60% |

| Lincoln | £5,976 | £25,000 | 23.90% |

| Sunderland | £5,940 | £25,000 | 23.76% |

| Bradford | £6,000 | £26,000 | 23.08% |

| Worcester | £5,724 | £25,000 | 22.90% |

| Liverpool | £6,000 | £27,000 | 22.22% |

| Carlisle | £5,724 | £26,000 | 22.02% |

| Stoke on Trent | £5,400 | £25,000 | 21.60% |

| Kingston upon Hull | £4,944 | £25,000 | 19.78% |

| Aberdeen | £6,540 | £35,000 | 18.69% |

London Focus

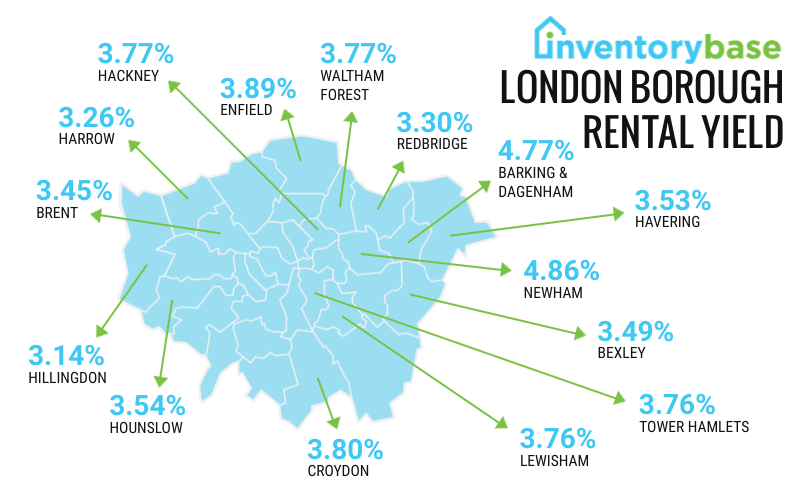

Rental Yield Map by London Borough

Rental Yield by London Borough

Only 4 of the top 10 London boroughs for rental yield are part of inner London, including Newham, Hackney, Lewisham and Tower Hamlets.

The most expensive borough for houses, Kensington and Chelsea also has the lowest estimated yield for rent.

| Borough | Average Rent P/A | House Prices | Estimated Rental Yield |

| Newham | £17,400 | £357,682 | 4.86% |

| Barking and Dagenham | £14,400 | £302,100 | 4.77% |

| Enfield | £15,600 | £400,600 | 3.89% |

| Croydon | £14,400 | £379,000 | 3.80% |

| Hackney | £20,700 | £549,200 | 3.77% |

| Lewisham | £16,200 | £430,982 | 3.76% |

| Tower Hamlets | £21,000 | £559,014 | 3.76% |

| Hounslow | £15,600 | £441,193 | 3.54% |

| Havering | £13,440 | £380,500 | 3.53% |

| Bexley | £13,200 | £378,200 | 3.49% |

| Brent | £17,160 | £498,100 | 3.45% |

| Waltham Forest | £16,200 | £471,825 | 3.43% |

| Redbridge | £15,300 | £463,560 | 3.30% |

| Harrow | £15,900 | £487,800 | 3.26% |

| Hillingdon | £15,300 | £487,300 | 3.14% |

| Haringey | £18,000 | £576,100 | 3.12% |

| Islington | £22,152 | £722,179 | 3.07% |

| Westminster | £31,908 | £1,087,312 | 2.93% |

| Lambeth | £20,388 | £699,899 | 2.91% |

| Sutton | £14,100 | £487,429 | 2.89% |

| Greenwich | £16,200 | £565,800 | 2.86% |

| Bromley | £15,000 | £527,200 | 2.85% |

| Merton | £18,000 | £633,685 | 2.84% |

| Kingston upon Thames | £16,200 | £586,406 | 2.76% |

| Camden | £26,004 | £975,100 | 2.67% |

| Barnet | £16,800 | £630,900 | 2.66% |

| Wandsworth | £21,000 | £795,638 | 2.64% |

| Southwark | £19,800 | £752,841 | 2.63% |

| Hammersmith and Fulham | £22,200 | £902,200 | 2.46% |

| Ealing | £18,000 | £793,700 | 2.27% |

| Richmond upon Thames | £19,200 | £978,457 | 1.96% |

| Kensington and Chelsea | £32,496 | £2,014,392 | 1.61% |

Rent as a Percentage of Income by London Borough

Based solely on averages, residents of Westminster can expect to pay more than 99% of their wages on rent. Islington, Kensington and Camden all also have an average rent valued at more than 80% of the borough’s average salary.

On the other end, Havering, Redbridge and Croydon have an average rent less than 50% of the average salary, suggesting they are the most affordable areas of the capital to live as private renters.

| Borough | Average Rent P/A | Average estimated salary | % of wage on rent |

| Westminster | £31,908 | £32,000 | 99.71% |

| Islington | £22,152 | £24,000 | 92.30% |

| Kensington and Chelsea | £32,496 | £37,000 | 87.83% |

| Camden | £26,004 | £32,000 | 81.26% |

| Richmond upon Thames | £19,200 | £25,000 | 76.80% |

| Lambeth | £20,388 | £28,000 | 72.81% |

| Tower Hamlets | £21,000 | £29,000 | 72.41% |

| Hammersmith and Fulham | £22,200 | £31,000 | 71.61% |

| Brent | £17,160 | £24,000 | 71.50% |

| Merton | £18,000 | £26,000 | 69.23% |

| Wandsworth | £21,000 | £31,000 | 67.74% |

| Newham | £17,400 | £26,000 | 66.92% |

| Hillingdon | £15,300 | £23,000 | 66.52% |

| Barking and Dagenham | £14,400 | £22,000 | 65.45% |

| Hounslow | £15,600 | £24,000 | 65.00% |

| Hackney | £20,700 | £33,000 | 62.73% |

| Enfield | £15,600 | £25,000 | 62.40% |

| Barnet | £16,800 | £27,000 | 62.22% |

| Southwark | £19,800 | £32,000 | 61.88% |

| Waltham Forest | £16,200 | £27,000 | 60.00% |

| Kingston upon Thames | £16,200 | £27,000 | 60.00% |

| Ealing | £18,000 | £30,000 | 60.00% |

| Harrow | £15,900 | £29,000 | 54.83% |

| Lewisham | £16,200 | £30,000 | 54.00% |

| Greenwich | £16,200 | £30,000 | 54.00% |

| Bexley | £13,200 | £25,000 | 52.80% |

| Sutton | £14,100 | £27,000 | 52.22% |

| Haringey | £18,000 | £35,000 | 51.43% |

| Bromley | £15,000 | £30,000 | 50.00% |

| Croydon | £14,400 | £30,000 | 48.00% |

| Redbridge | £15,300 | £36,000 | 42.50% |

| Havering | £13,440 | £32,000 | 42.00% |

Sources

- https://www.zoopla.co.uk/

- https://www.payscale.com/

- https://www.london.gov.uk/

- https://www.ons.gov.uk/

- https://www.gov.scot/

- https://commonslibrary.parliament.uk/

Data collected by InventoryBase, residential property inspection software providers in the UK.